Designing confidence-gated AI systems that make uncertainty legible, preserve human authority, and prevent over-delegation in high-stakes decisions.

Introduction

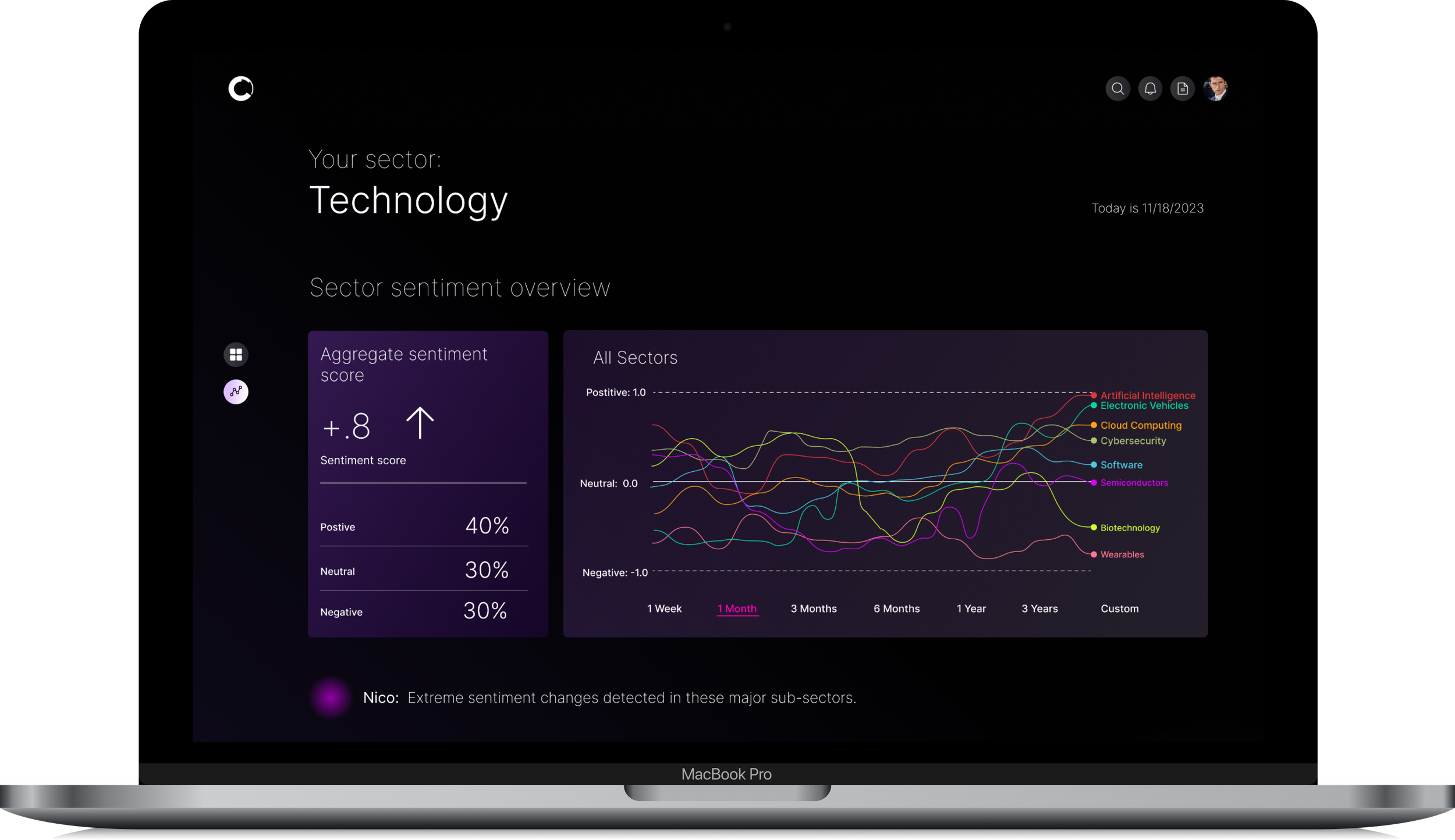

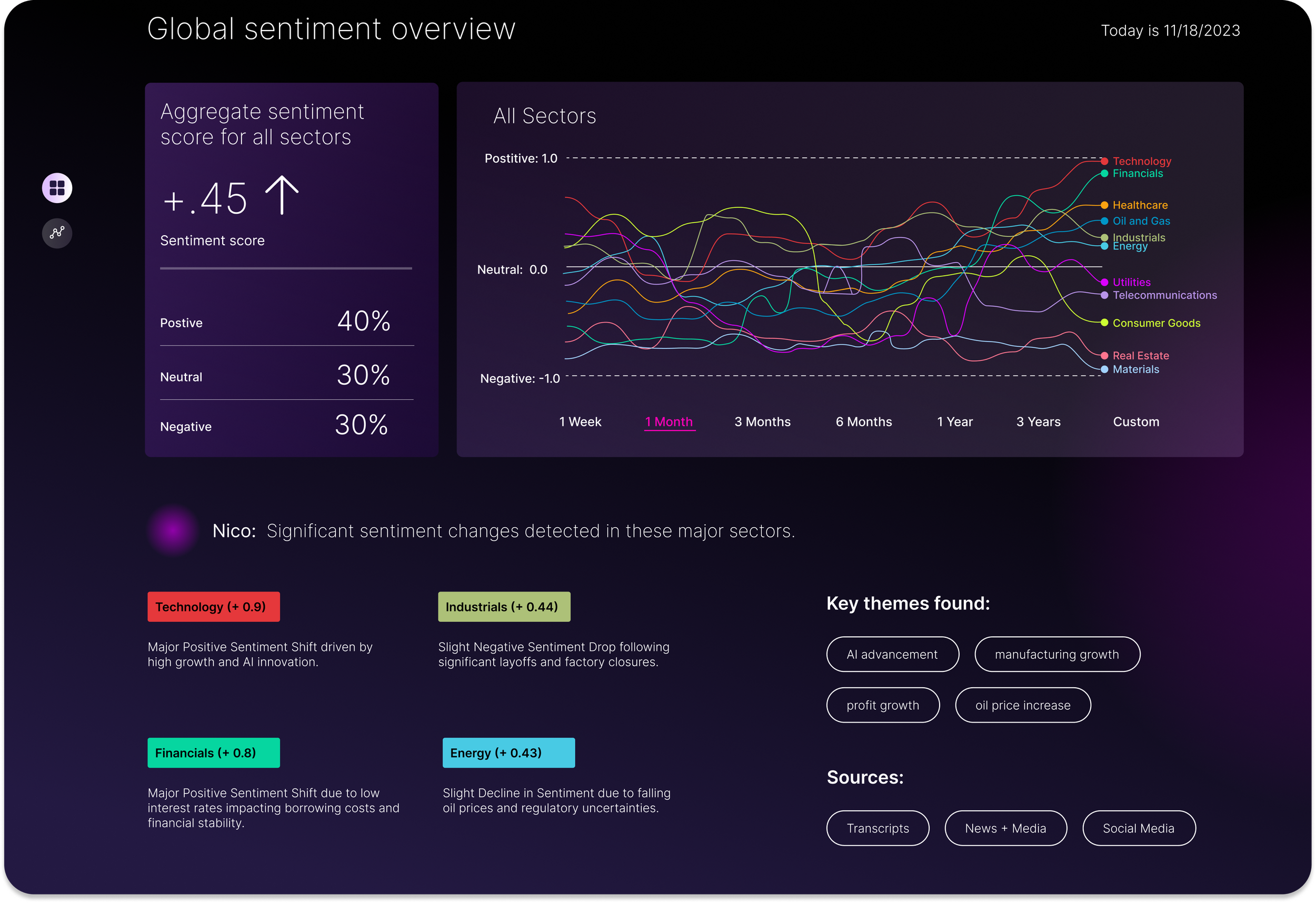

Nico is a decision-intelligence system designed to help humans reason with probabilistic AI outputs under uncertainty.

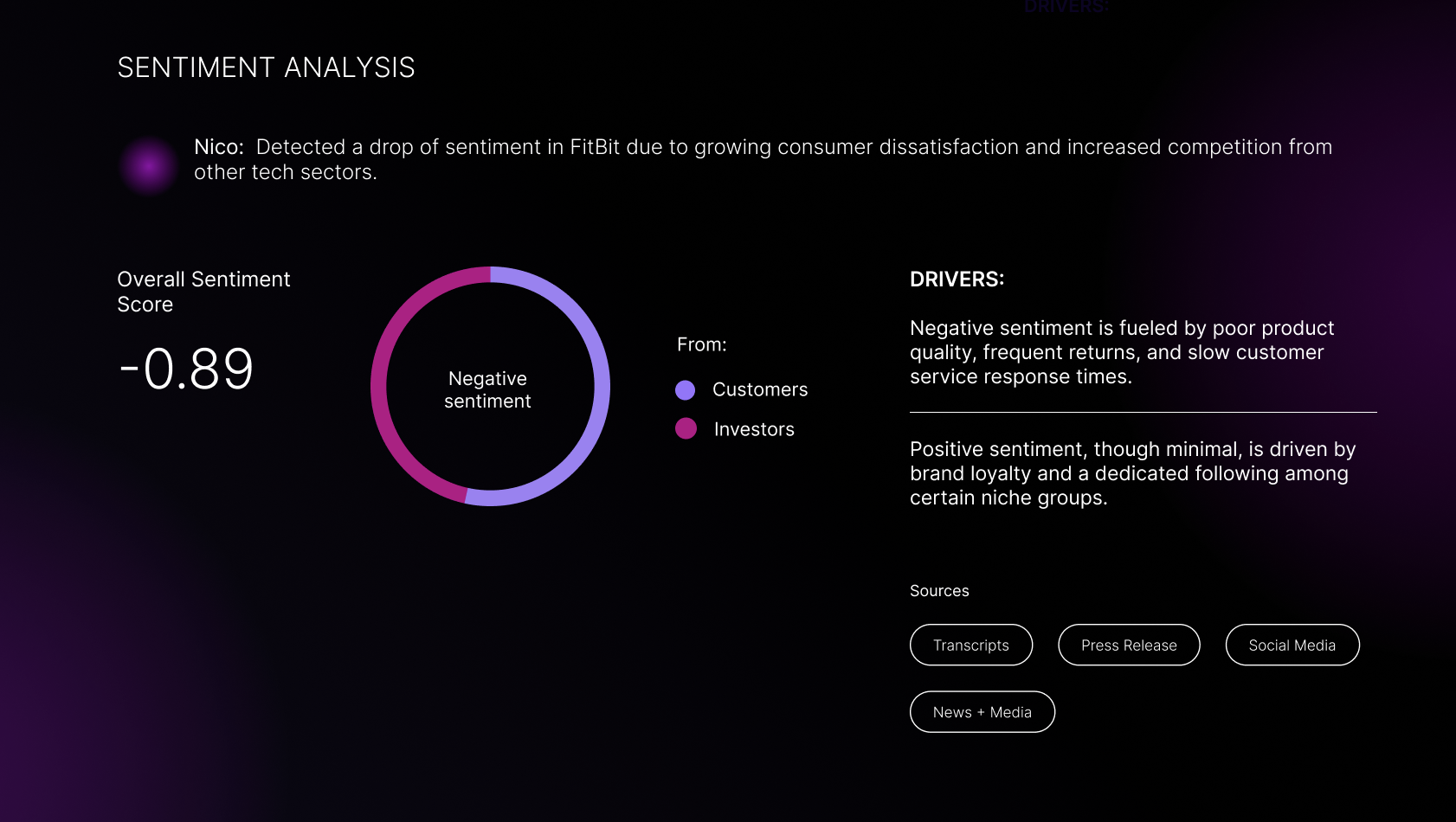

It focuses on trust calibration, sentiment analysis, confidence-gated automation, and human authority at high-impact decision boundaries.

Who is this for and why now?

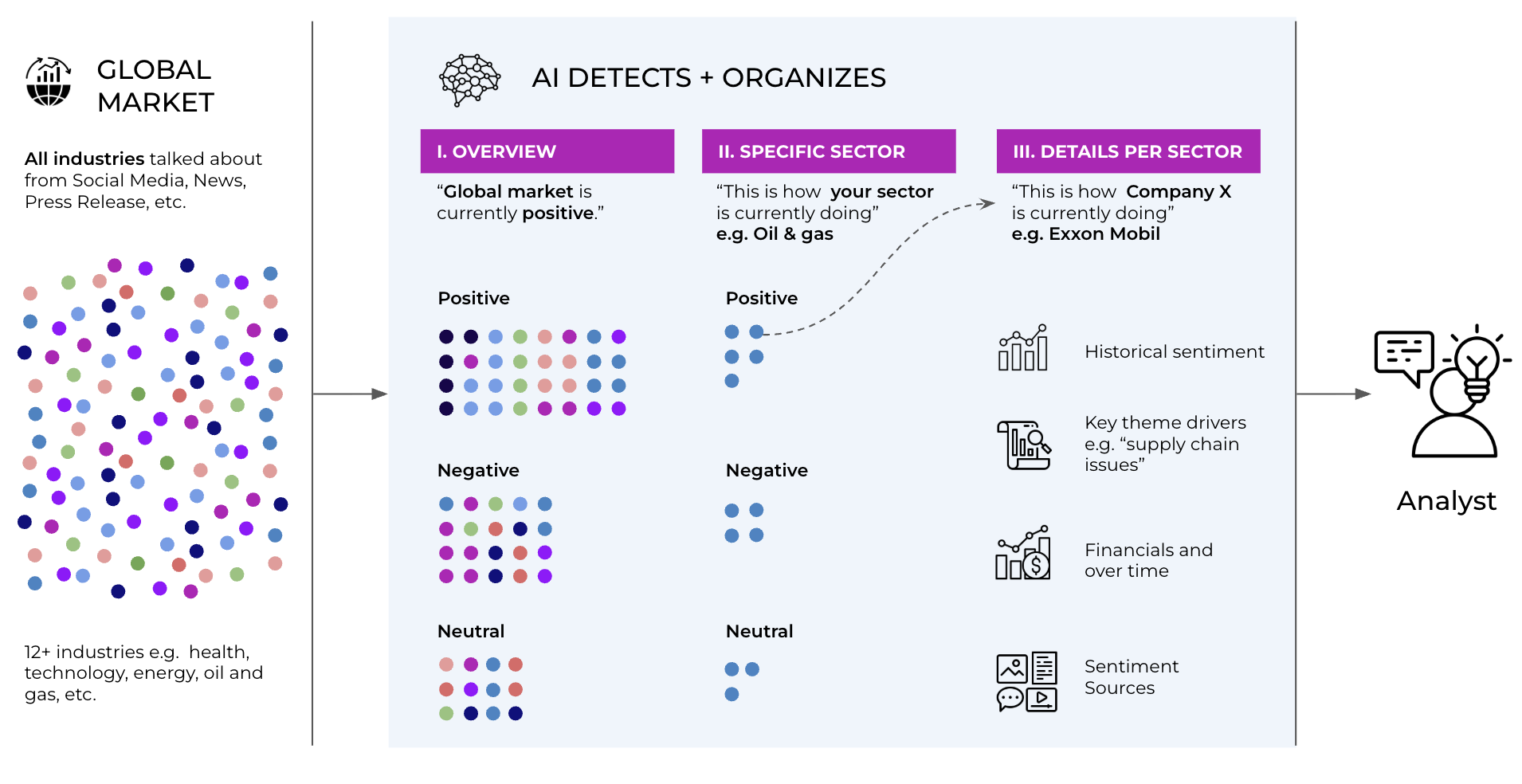

Nico helps financial analysts anticipate market shifts by applying AI-driven sentiment analysis as a predictive input. By surfacing emerging signals across news, discourse, social media and executive narratives, it supports higher-confidence decisions under uncertainty.

For example, Nico can be a decision-intelligence system for financial analysts in Private Equity. It uses AI-driven sentiment as a predictive signal to support research analysis, helping firms understand what’s driving markets, assess risk earlier, and make better investment decisions under uncertainty or make well-informed predictions.

My Role

My work centered around the AI behavior, interface design, and organizational accountability.

I led the system design and epistemic UX architecture for a predictive analytics framework focused on:

Trust calibration

Human–AI decision boundaries

Scenario reasoning over point estimates

Making uncertainty legible without overwhelming users

TEAMMATES & COLLABORATORS

• 2 ML Engineers

• 1 ML Lead

• 1 Fullstack Software Engineer

• 1 SME

Core Insight

Prediction is not an answer, but a distribution of futures.

Most AI systems collapse uncertainty into a single output.

Nico preserves uncertainty and designs the interface to help humans reason through it.

This reframes AI from:

“What is the answer?”

- to -“What do we know, how confident are we, and what happens if we’re wrong?”

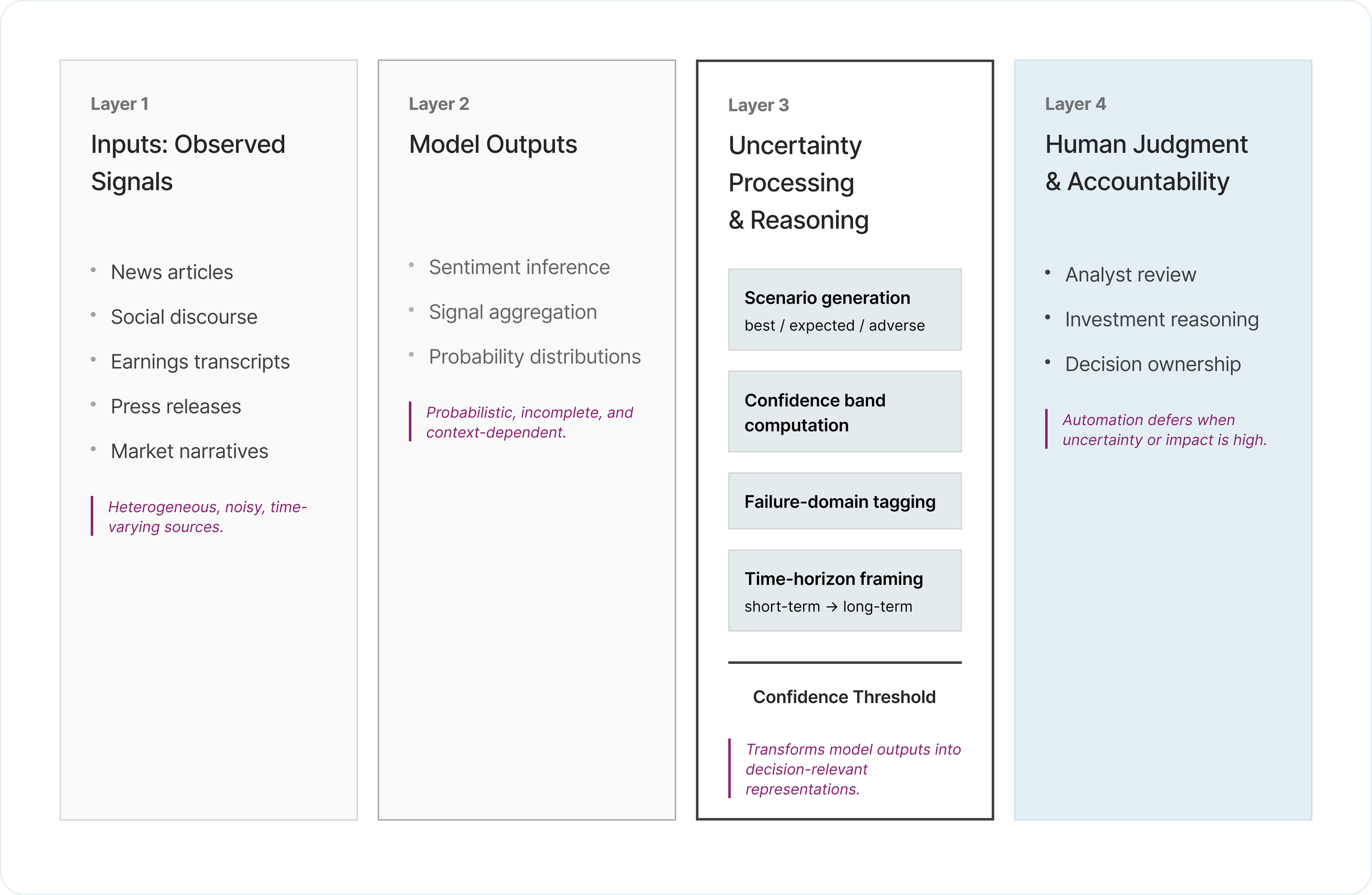

System Architecture Diagram

Nico processes model uncertainty through scenario reasoning, confidence bands, and temporal framing to support human authority at high-impact decision boundaries.

Through this architecture, I learned that analysts don’t need more signals; they need clarity about which signals matter, how signals can change, and when it’s too early to act. Treating uncertainty as a first-class design object and encoding that logic into the system improved research judgment more than adding data, enabling safer delegation, epistemic humility, and more accountable decision-making

Design Principles

01.

Uncertainty Communication: Confidence vs Correct

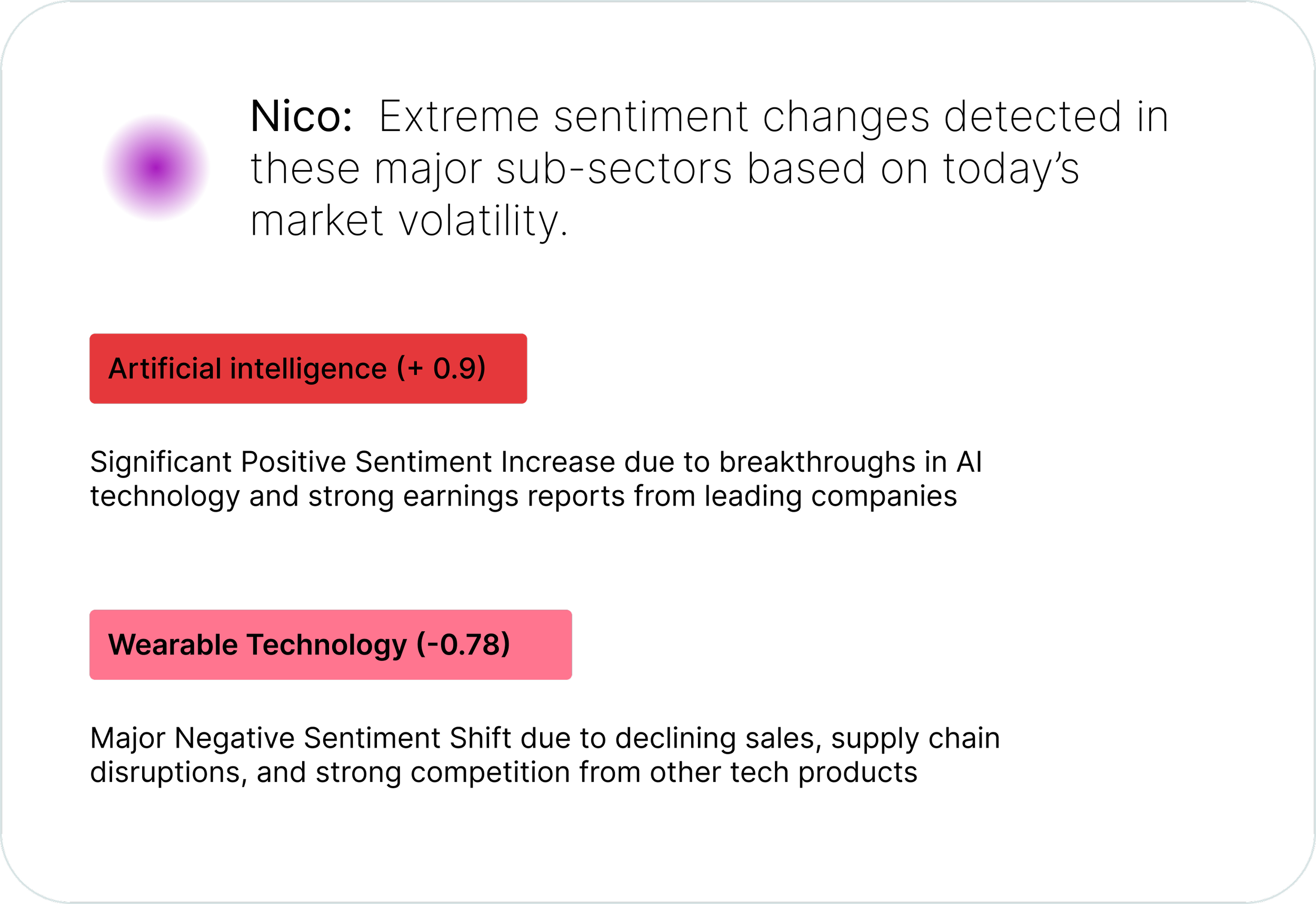

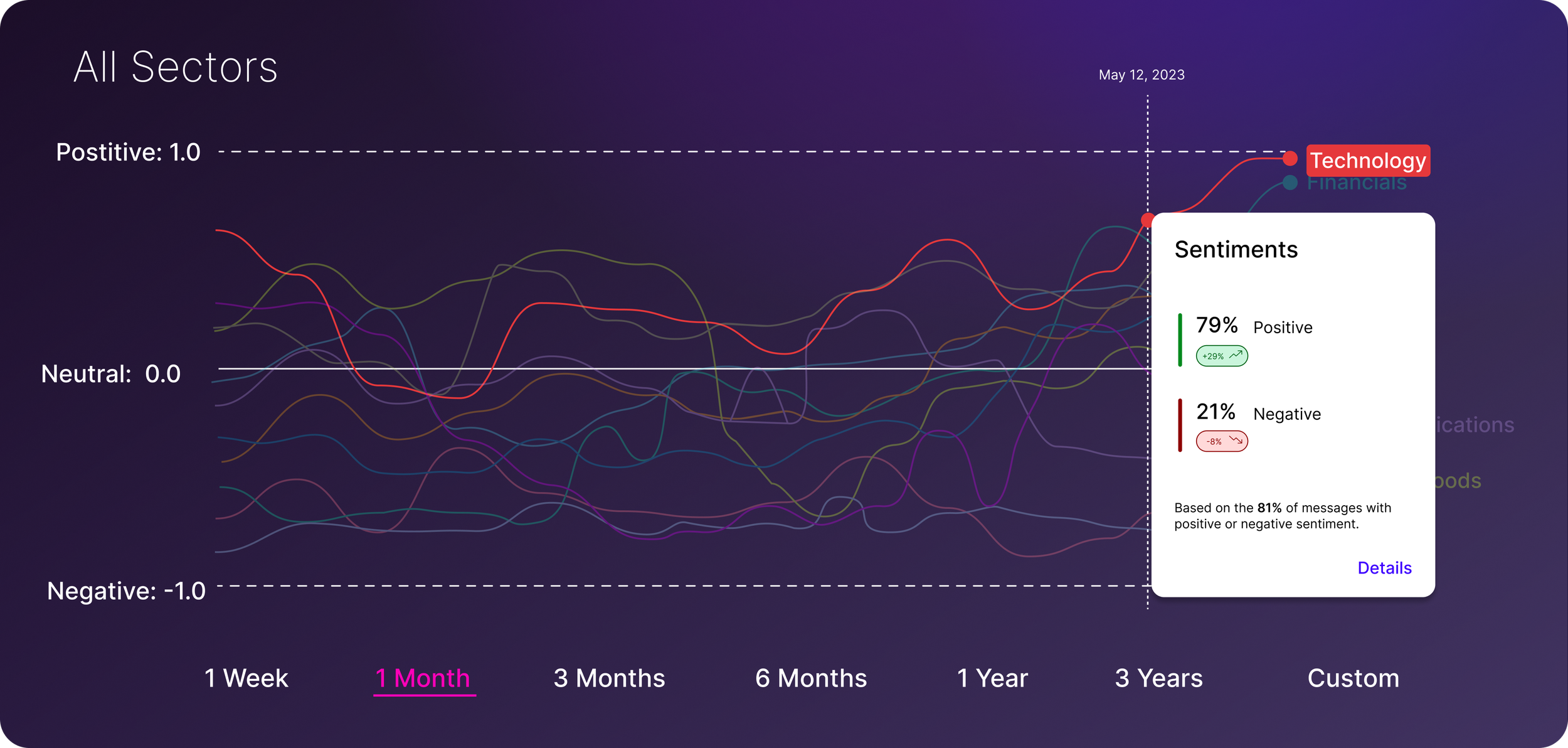

Part of this interface prevents over-trust by showing how time sensitive (market changes) or robust a signal is, rather than presenting a single authoritative answer.

“Wide variance indicates low certainty despite a positive trend.”

“Neutral signals preserved instead of forced classification.”

“Confidence bands widen as data freshness decreases.”

“Key drivers found in specific sectors based on these current sources.”

02.

Scenario Reasoning Interface

Analysts reason across plausible futures and trade-offs, instead of selecting a single predicted outcome.

Displays parallel sentiment trajectories across sectors rather than collapsing signals into a single score

Enables comparison across time horizons, where the same signal can imply different conclusions depending on context

Surfaces divergence and second-order effects that would be hidden by ranked or aggregated outputs

03.

Epistemic Inputs: What the System Knows, When It Knows It, and How Stable It Is

Nico surfaces not just sentiment outcomes, but the structure of the inputs behind them, signal sources, freshness, volatility, and attribution, so analysts can reason about confidence and fragility before acting.

Signal types: news media, earnings transcripts, press releases, social discourse

Source attribution: customer sentiment, investor sentiment, and market narratives

Freshness & coverage: recency of signals and proportion of data contributing to the score

Volatility & noise: differentiation between sustained trends and short-term fluctuations

Prototype