Thurston App

Thurston leads a revolution in personal investing, offering a seamless and empowering experience crafted for the modern investor. Specifically designed to cater to millennials and novice investors, Thurston provides a refreshing approach to navigating the complexities of finance, instilling confidence as users navigate the previously unknown terrain of investing.

Impact

Beta release of the app’s search feature increased millennial engagement by 3.3%.

Identified top areas of investor interest: clean energy, cannabis, gaming, EVs.

De-risked investment in new product direction by validating demand for a millennial-focused app before committing full resources.

Takeaway: Thurston positioned the business to expand into a new demographic without disrupting its existing customer base.

Structure

My Role:

Design Strategy

User Research

UX/UI Lead

Branding

Visual Design

Teammates:

Product Manager

3 Engineers

Timeline:

• 3 months design

• 3 months development

• 6 months total to launch an MVP

Context

Thurston aimed to attract and retain millennial investors (ages 20–35), a demographic underserved by traditional financial platforms.

Leadership wanted a product that made investing more approachable, while protecting the core brand and existing customer relationships.

Problem

Existing offerings were too complex or intimidating for first-time investors.

Without simplification, transparency, and mobile-first experiences, millennials were likely to turn to fintech disruptors instead.

The challenge was to design a product that lowered the barrier to investing while aligning with Thurston’s long-term strategy.

Approach

Research & Personas

Interviews and competitive analysis revealed that 54% of millennials hesitated to invest due to lack of knowledge, highlighting the need for simpler, more educational flows.

Concept Testing

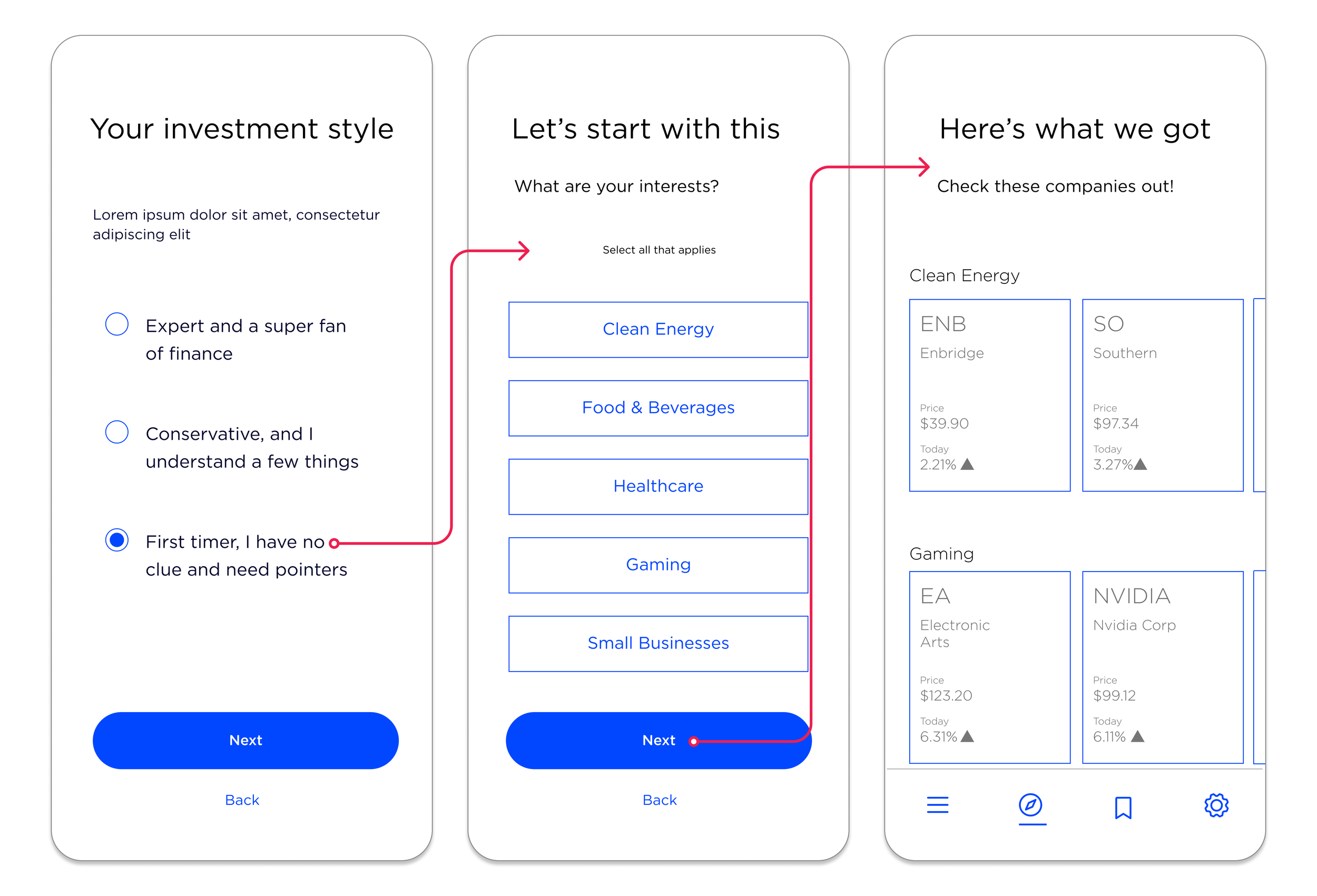

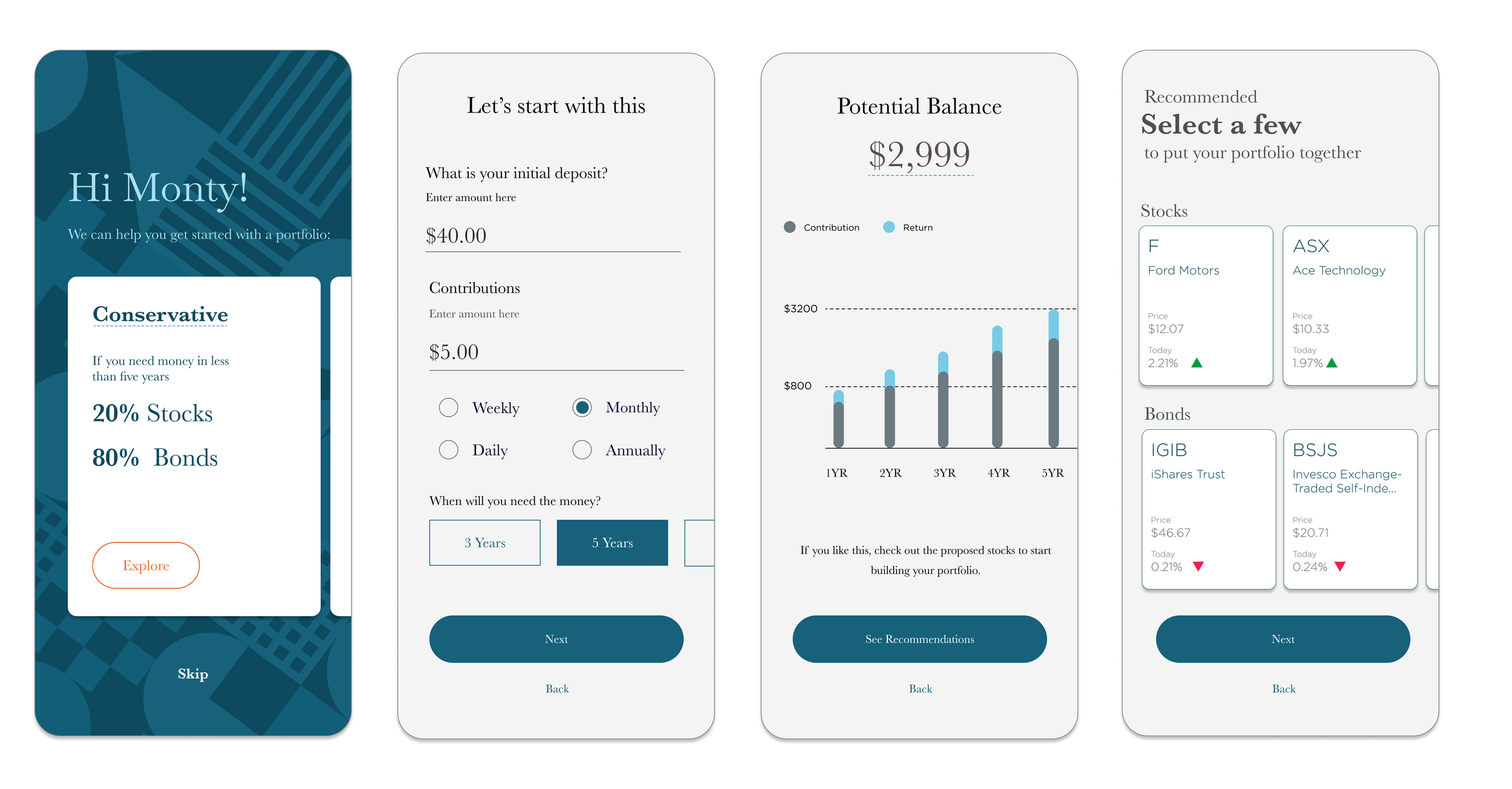

Testing multiple concepts (robo-advisor, thematic investing) showed that users gravitated toward thematic investing because it felt relatable and values-driven, not abstract or intimidating.

Prototyping & Iteration

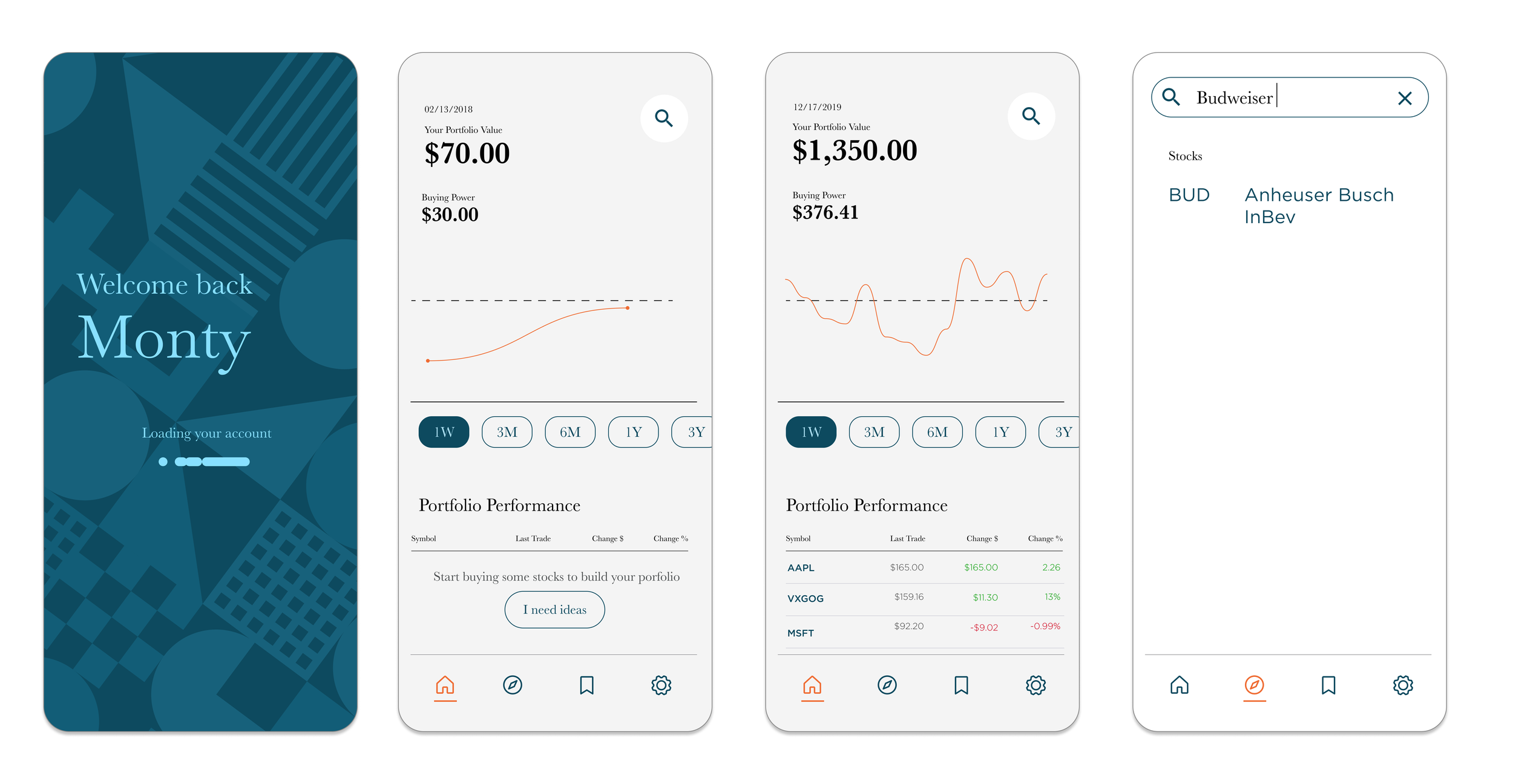

High-fidelity testing of onboarding, portfolio tracking, and thematic investing revealed that clarity and transparency directly increased user confidence and willingness to take the first step.

Market Positioning

Collaborating with marketing confirmed adoption signals positioning the app around accessibility and value-based investing resonated, reducing risk and shaping the go-to-market strategy.

Solution

01. Personalized Themes: Investment choices aligned with user values (e.g., clean energy, cannabis, gaming, EVs).

02. Simplified Guidance: A mobile-first app with clear entry points for stock selection and portfolio tracking.

03. Trust & Transparency: Clear visuals, plain-language explanations, and easy fund transfer flows.

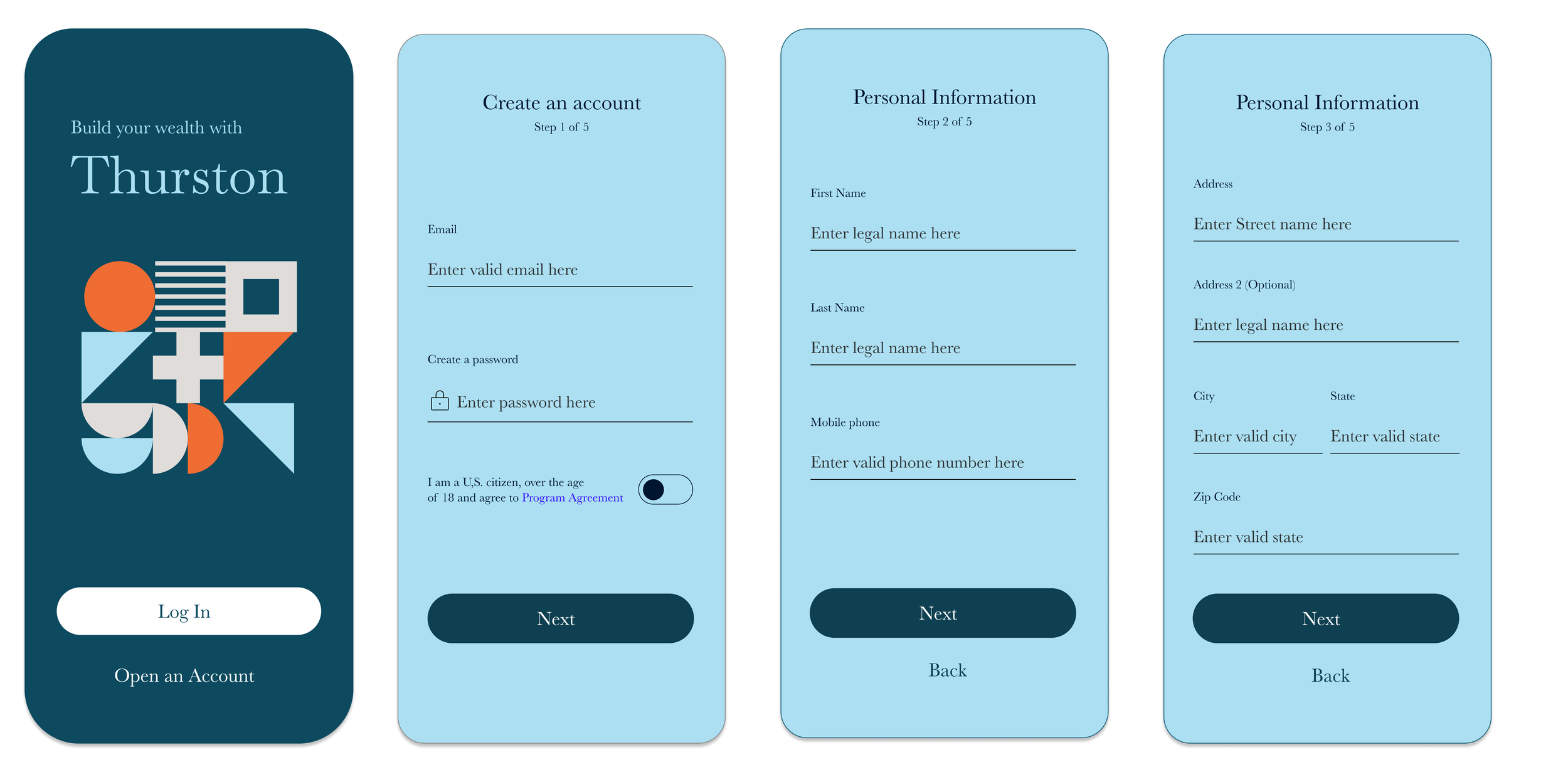

04. Seamless Onboarding: A beginner-friendly journey that built confidence without overwhelming users.

Learnings

Accessibility matters: Simplified flows and thematic investing lowered barriers for first-time investors.

Market resonance is critical: Users cared about aligning investments with personal values.

Partnership between product + marketing paid off: Validating positioning early prevented wasted resources.

Lesson: Even when resources are constrained, testing with real users can shape strategy, confirm market fit, and reduce risk.