Meet Warren

A conversational AI designed specifically for Private Equity and Investment Bankers. Get instant access to real-time financial data, M&A activity, and company performance insights, all through simple, natural language. Save time, make smarter decisions, and streamline workflows with personalized information and proactive insights. Warren helps financial and industry leaders stay ahead, from evaluating deals, managing portfolios, or advising clients.

Impact

As the Principal Product Designer, I led the design and development of Warren, a conversational AI platform tailored for Private Equity (PE) firms and Investment Bankers.

Product design helped private equity and investment professionals cut research time by up to 50%, improving decision-making speed.

Created a trusted interface where users could confidently rely on AI outputs for sentiment, market signals, and portfolio insights.

Demonstrated how AI could act as a financial copilot, building trust by combining transparency, error prevention, and domain knowledge.

Takeaway: Trust in AI for finance requires more than insights; finance professionals demand clarity, confidence, and alignment with professional workflows.

Context

Financial analysts face pressure to make fast, accurate decisions. They need real-time insights into markets, sentiment, and deal signals, but existing tools required manual research and were fragmented across platforms.

Structure

My Role & Responsibilities:

Design Strategy

User Research

UX Lead

Visual Design

Teammates:

Product Manager

3 ML Engineers

1 Software Engineer

3 SMEs

Timeline:

• 6 Months launch MVP

Problem

Early AI pilots in finance often produced hallucinations or lacked transparency, which eroded user trust. Analysts worried about basing million-dollar decisions on an unreliable AI output.

The challenge was to design an AI experience that:

Built trust and confidence with analysts.

Delivered clear, actionable insights without overwhelming.

Fit seamlessly into workflows where speed and real-time accuracy are critical.

Content that’s easy to read and scannable to get critical insights.

First MVP

Approach

Research & Discovery

I interviewed our users: 7 investment bankers, 5 PE associates, and analysts to uncover their daily pain points.

Revealed that PE and IB users valued speed and mobile accuracy above all:

Needed instant access to financial metrics like EBITDA during due diligence.

Wanted real-time market and M&A updates on the go to prepare for client meetings.

Sought a single source of truth, instead of wasting time piecing data across tools.

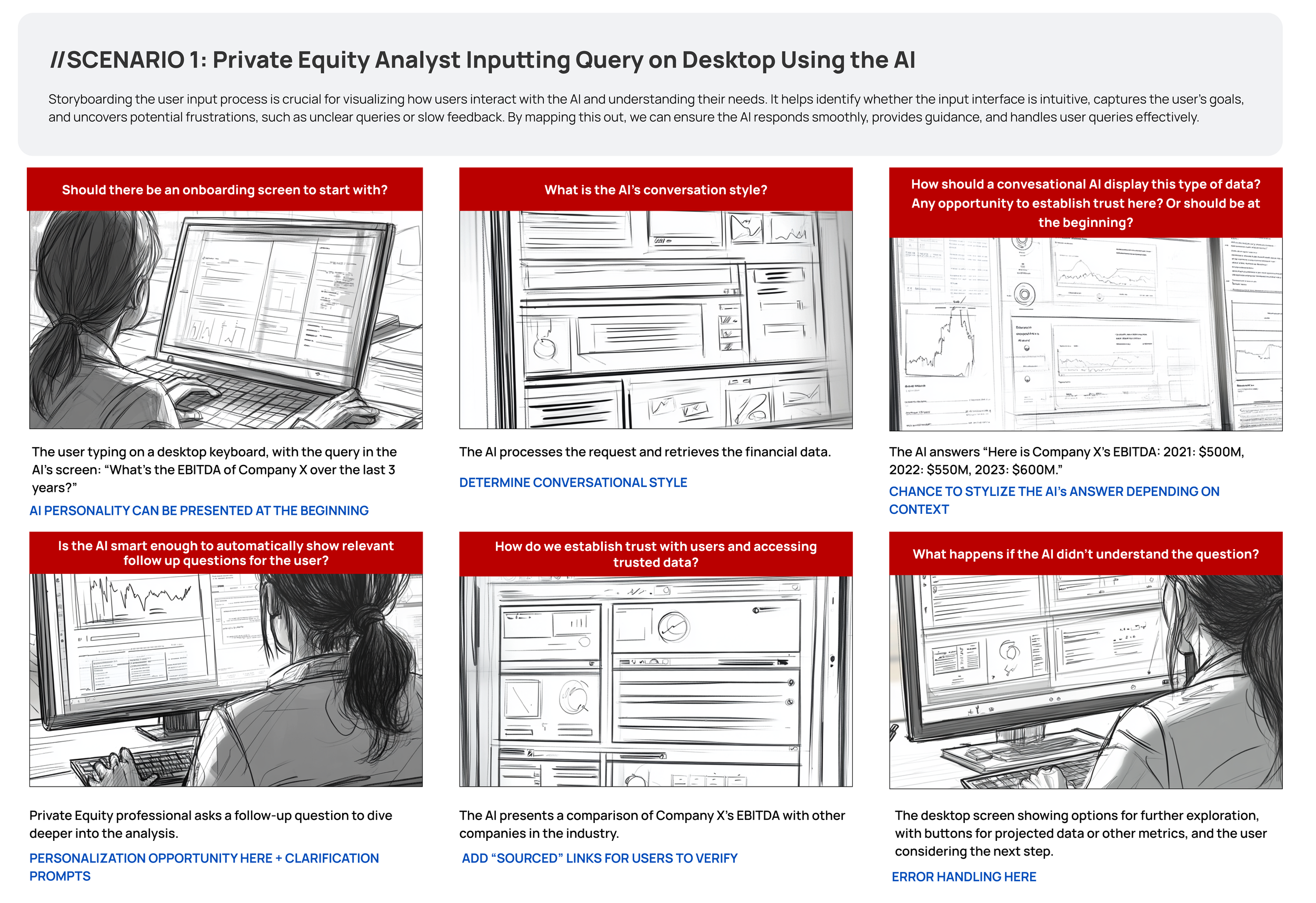

Storyboarding Workflows

After the user research, I was able to understand their workflows, and I used a storyboard method instead of a map to help further understand how the users prefer to interact with an AI.

Showed that users trusted the AI most when it:

Balanced professionalism with approachability in tone.

Handled errors gracefully, without breaking the flow.

Maintained contextual awareness, so conversations felt natural and continuous.

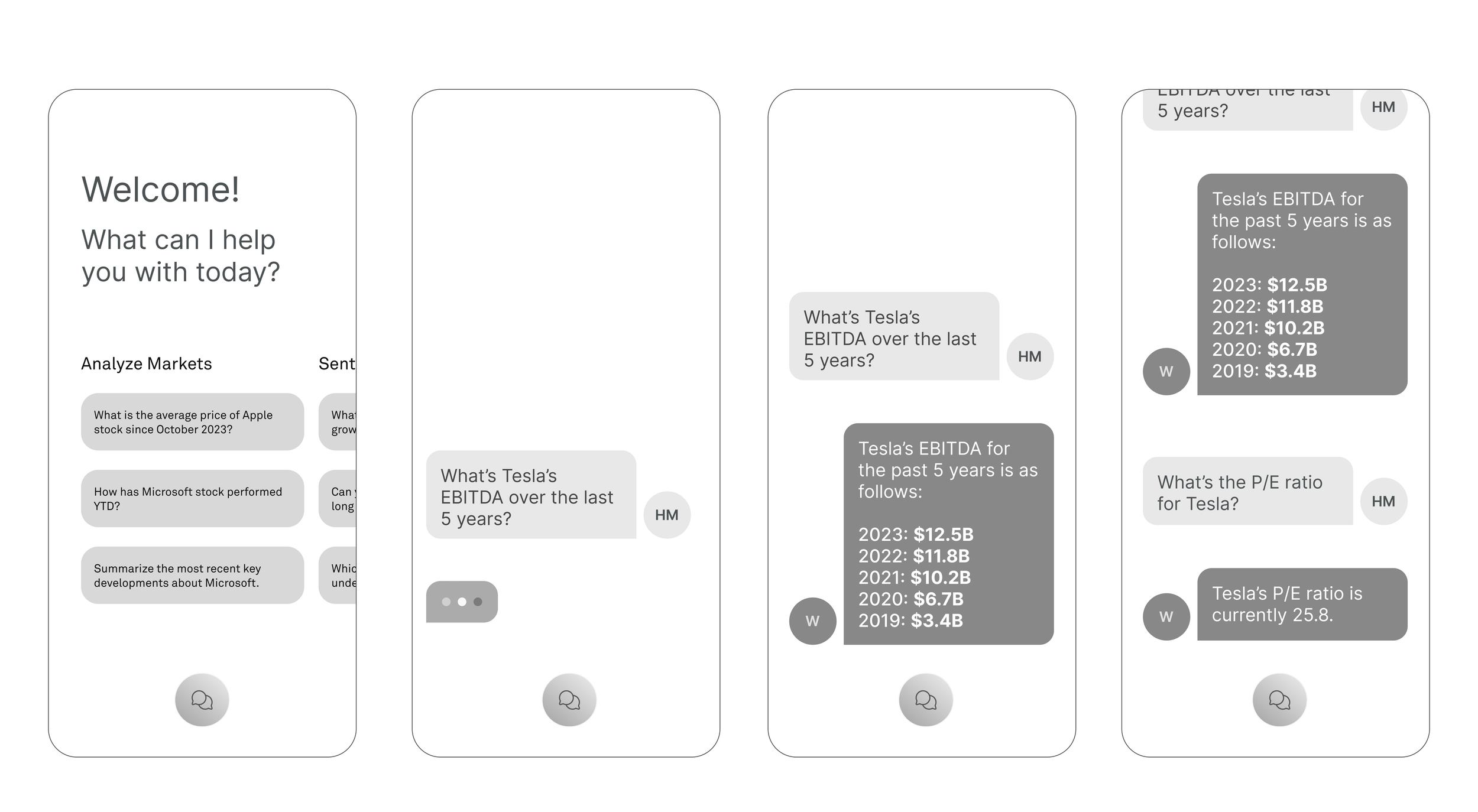

Rapid Prototyping

I tested conversational AI against structured dashboards to compare usability.

Testing conversational AI against dashboards revealed that a hybrid model worked best:

Natural-language queries gave analysts flexibility.

Structured outputs provided clarity and confidence in results.

Iteration

I refined based on ongoing feedback, simplifying flows, adding transparency, and reducing ambiguity.

Ongoing feedback proved adoption increased when the AI:

Displayed confidence scores for transparency.

Provided clear sourcing for credibility.

Included error handling to reduce ambiguity and build trust.

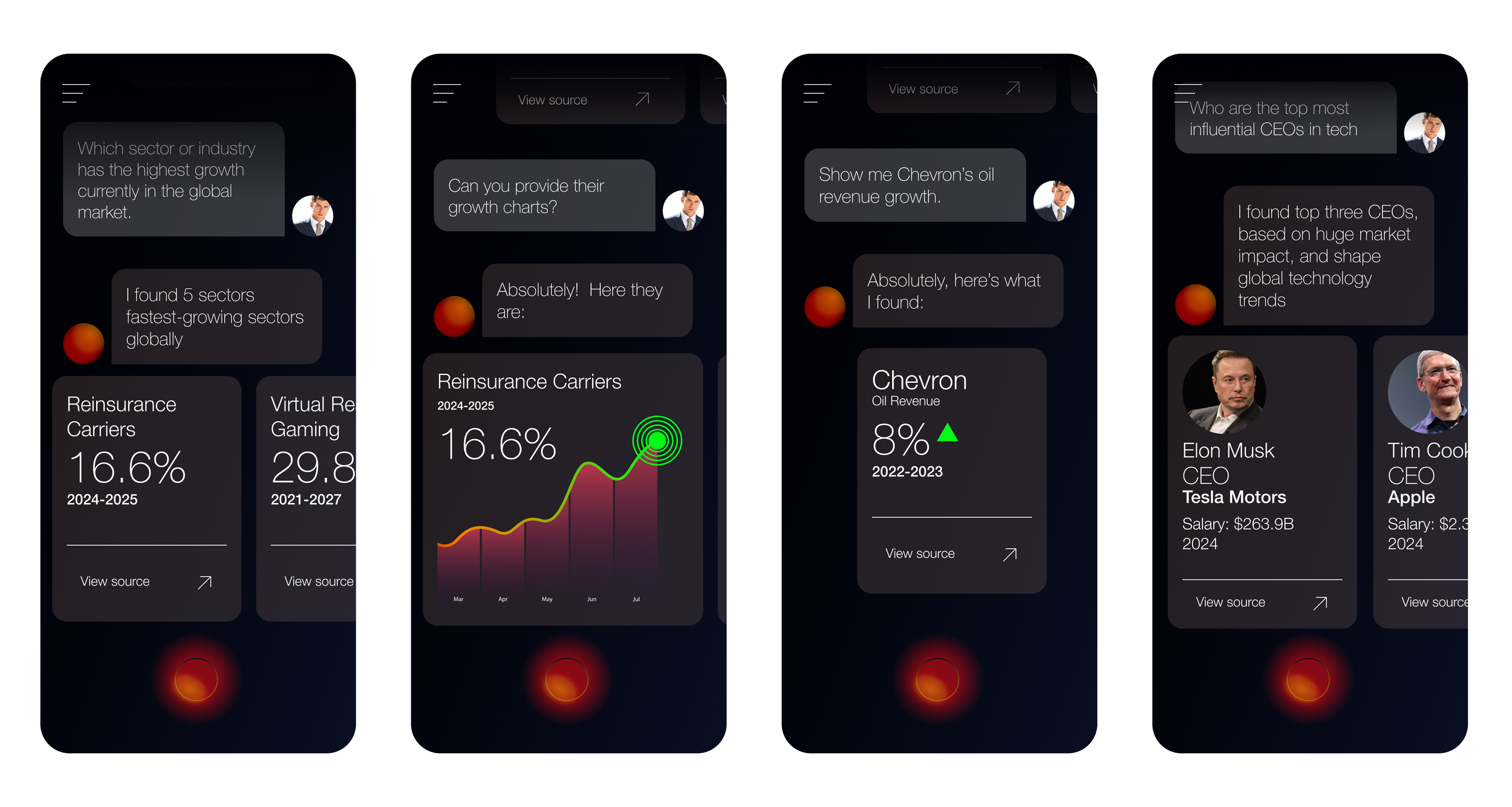

Solution

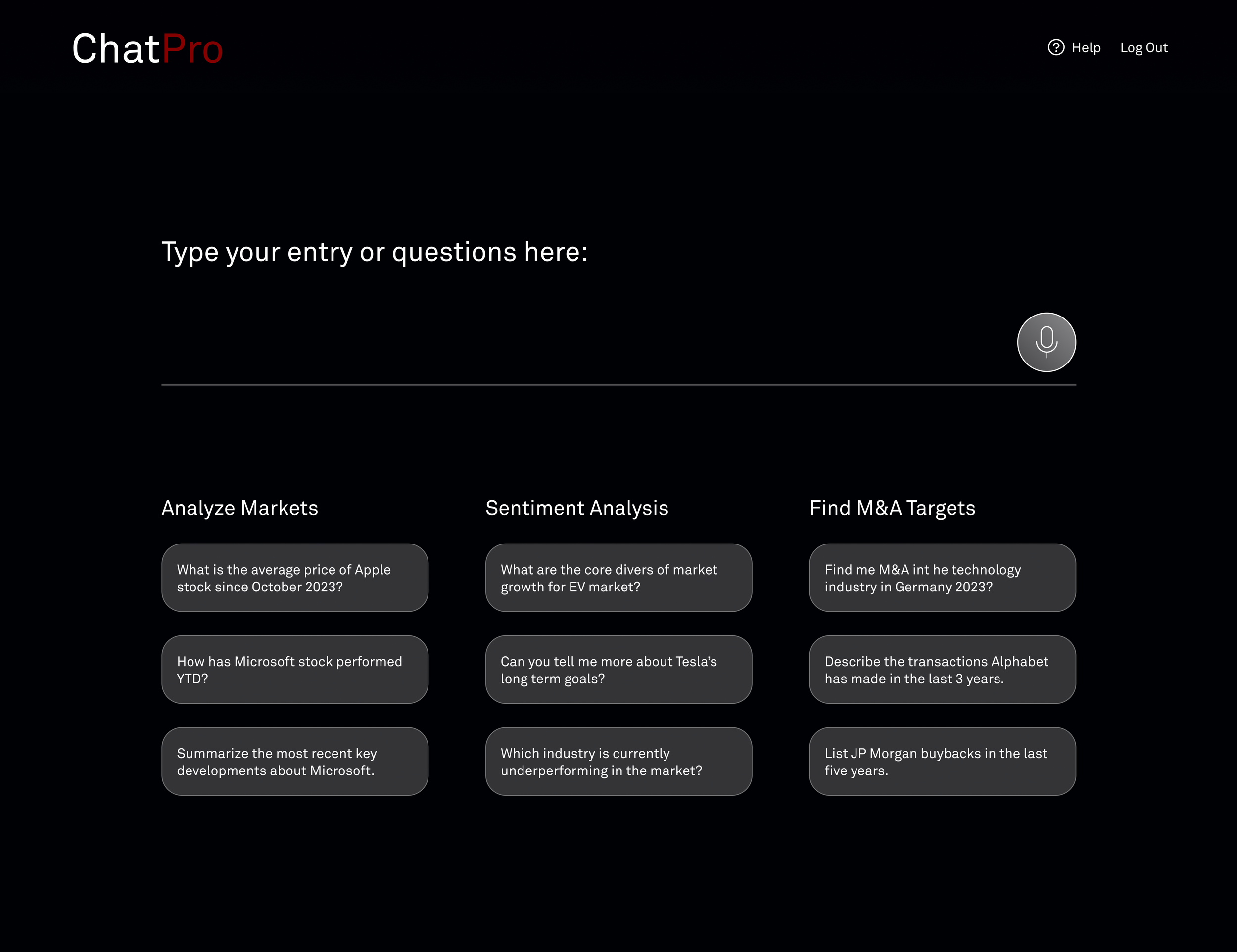

Conversational Interface: Allowed analysts to ask natural-language questions, with Warren clarifying if queries were too broad, ensuring relevance and accuracy.

Warren was designed as a confident, calm, and helpful copilot, an approachable in tone yet professional enough for high-stakes financial work.

01.

Stats & Charts for Quick Scanning: Delivered structured insights, sentiment, and deal metrics in visual formats that analysts could review at a glance.

02.

Transparency Features: Built trust by verifying sources, showing confidence scores, and handling errors gracefully so users never relied blindly on outputs.

03.

Clarifying a vague or broad questions: When users asked overly broad questions, Warren prompted them to clarify or narrow their query. This reduced irrelevant results, saved analysts’ time, and reinforced trust by showing the AI understood their intent rather than guessing.

04.

Prototype

Learnings

Trust is central: Users won’t adopt AI for finance unless it feels credible, accountable, and error-resistant.

Speed matters: Reducing research and switching time was just as important as insight quality.

Personality helps: Framing the AI with recognizable archetypes made the concept relatable and less intimidating.

Transparency drives adoption: Confidence scores and visible sources helped overcome skepticism around AI “black boxes.”